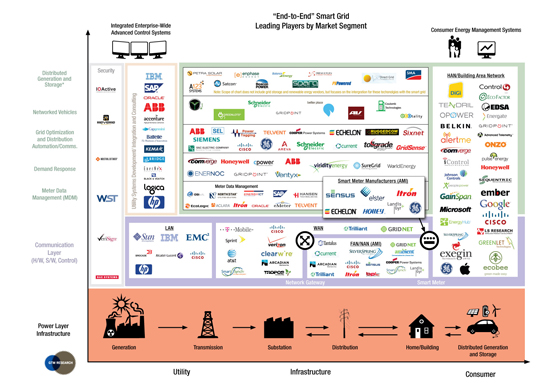

GTM Research updates Smart Grid Market Taxonomy and sizes the market through 2015

Before we talk about the size of this market through 2015, let's take a look at an updated version of our smart grid market taxonomy that first appeared last year in a free report that GTM Research published, titled "The Smart Grid in 2010: Market Segments, Applications and Industry Players." As part of a new, quantitative report we published last week, titled "United States Smart Grid Market Forecast: 2010 - 2015," we decided to update the taxonomy in much greater detail, spelling out exactly where every player in the market is positioned. It's a very useful diagram to help readers understand who's who and who does what in the larger smart grid universe. Take a look! (Click on the image below to see a larger version.)

Source: GTM Research

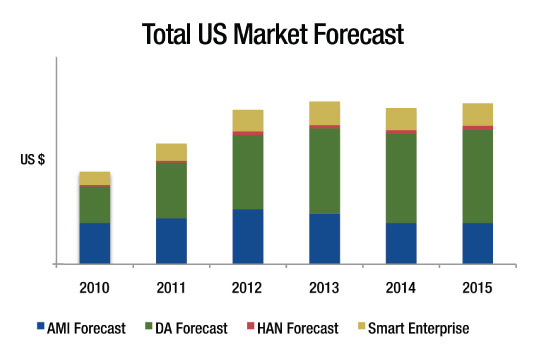

The GTM report "U.S. Smart Grid Market Forecast: 2010 to 2015" examines the growth of this emerging industry. In this analysis, we review the most critical market trends, provide a detailed forecast of this market over the next five years, and provide an update of our well-known Smart Grid Vendor Taxonomy (as noted above), as well as offer insight into how we think different players and sub-markets are positioned to move forward. GTM Research expects the smart grid to grow from a $5.6 billion market in 2010 to $9.6 billion in 2015. This forecast was arrived at by adding together the following four submarket segments : Advanced Metering Infrastructure (AMI), Distribution Automation (DA), Home Area Networks (HAN), Smart Utility Enerprise

Source: GTM Research

Smart meters will continue to be deployed widely in the near future; indeed, we expect a 48% national deployment by 2015. However, the eventual build-out of the true smart grid must include adding communications capabilities and intelligence to the actual distribution grid, as well as the back-end utility systems, in order to make greatest use of this newly generated data. While these deployments will take decades to reach full penetration, utility executives are beginning to recognize that a robust communications architecture will be the backbone upon which all future applications will be built, and that without a smart enterprise, the nation’s grids will not be sufficiently intelligent to proactively manage demand, re-route power around disturbances, integrate distributed renewables and electric transportation, and most importantly, to continue to offer reliable and affordable electricity.

Today, advanced metering infrastructure (AMI) is the largest smart grid market segment, with approximately 45% of the total market share, due in part to the recent ARRA stimulus grants that went overwhelmingly toward smart metering projects. GTM Research expects AMI’s market share to shrink to 26% by 2015 as distribution automation (DA) continues to grow in significance and emerges as the dominant sector of the smart grid. In this report, we are forecasting DA to grow from 40% of the total market in 2010 to 58% by 2015. A fully networked grid would: allow for virtually every piece of grid equipment to have either automation or remote control; support the growth of much higher levels of intermittent, renewable energy as states race to meet approaching RPS standards; and, at a higher level, ensure that our national economy has the fundamental platform (reliable, dependable electricity) vital for the nation’s continued GDP growth.

In this report, each submarket is reviewed in detail, breaking out individual component and sub-component costs. For example, our AMI analysis breaks out the costs of the smart meter (including the metrology, the communications card for the AMI network, the communications card for home-area network, and remote disconnect capabilities). Our DA forecast is based on the continued and growing penetration of reclosers, capacitor banks, automated feeder switches and voltage regulators on the nation’s distribution grids.

More information about this report, please visit the link to the report.